It may sound like a simple process, but it can be extremely difficult to execute. Personal finance can be broken down into three simple steps: At the end of the day, retirement is all about dollars invested AND NOT your age. My hope is you'll be inspired to take charge of your own personal finance. I am an avid personal finance nerd sharing my thoughts on making money, saving money, budgeting, and escaping the rat race! Fortunately, you can buy any Vanguard ETF from any brokerage account. One of the common mistakes is thinking that you need to open a Vanguard account to purchase a Vanguard ETF. Therefore, you should always start shopping around by seeing what Vanguard has to offer. Most brokerages don’t come anywhere close on the cost basis for what Vanguard can provide. My personal preference is to invest with Vanguard. You do not need a Vanguard account to buy a Vanguard ETF. Most Vanguard ETFs have an expense ratio between 0.03% and 0.15%. Vanguard offers some of the lowest cost ETFs compared to any other brokerage. Plenty of brokerages offer an S&P Index Fund, so what are their fees? Where can I find low cost ETF fees? You may want to invest in S&P 500 Index Fund. What are the best things you can do as an investor is shop around. Most ETFs can’t outperform the market, so there’s no reason to overpay what you can already buy for a low price. However, every investor should try and get low cost exchange traded funds to avoid excessive fees. Good expense ratios for exchange-traded funds are typically below 0.2%. Why would you want to pay nearly an extra $150,000? What is a good expense ratio for an ETF? You are paying for tracking the exact same index. Assume you’re going to get an 8% return on investment.Ĭhoosing Investco over Vanguard will cost you an extra $144,566.38 in fees! Should you have invested with Vanguard, you would have only paid $4,000 in fees.īoth of these funds are an S&P 500 fund. Let’s assume you’ve got $10,000 invested and will keep investing $5,000 per year over 30 years. Unfortunately, not paying attention to ETF fees can be a very costly mistake. Most new investors don’t even pay attention to expense ratios. Invesco also has an S&P 500 fund, but with a 1.29% expense ratio!

The first ETF we will look at is VOO, the Vanguard S&P 500 ETF (expense ratio of 0.03%). Let’s look at two different S&P 500 exchange traded funds. Even a small difference in expense ratio can result in paying or saving a lot of money over time. However, you should avoid finding costly ETFs. Low-cost ETF fees are certainly worth the benefit they provide. You can use the expense ratio calculator to compare the overall cost of expense ratios of different ETFs. Use an expense ratio calculator to determine the overall impact of fees on your portfolio.

#Expense ratio calculator how to#

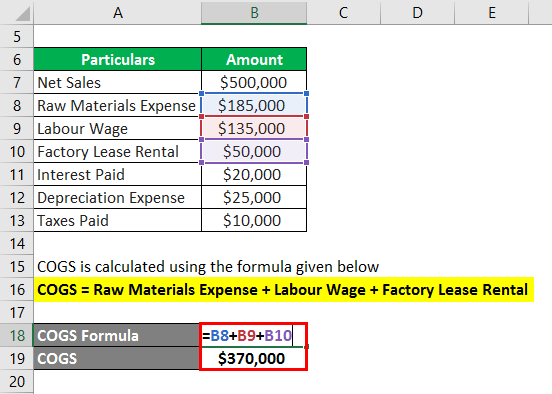

How to calculate the total cost of an ETF For example, a $50,000 portfolio with an expense ratio of 1% would have a yearly fee of $500.

Multiply the expense ratio as a decimal by your portfolio balance to determine the fee. How are ETF fees calculated?Įxpense ratios are an annual fee which is assessed on your portfolio balance. Lower turnover rates mean there is less buying or selling, which can have tax implications. Look for funds that have a low turnover rate. There will be a turnover fee associated with buying and selling those securities. So four percent of the stocks in VOO were replaced with something else. Turnover fees are separate from expense ratios and may create tax implications.įor example, VOO reported a turnover rate of four percent in their prospectus. A turnover fee is the cost associated with buying and selling a security, which the fund manager does for you. You should also note that an exchange traded fund may have other fees such as a turnover fee. Turnover fees are for buying and selling securities 0.01% of the expense ratio goes to other expenses. Looking through the VOO prospectus, I can see that 0.02% of the expense ratio goes to management fees. A prospectus is essentially a summary of the fund or information packet. When visiting their overview page, I can find all the information about the fund including the expense ratio.Īs you can see, Vanguard’s VOO has an expense ratio 0.03%.Įach fund includes a prospectus. For example, VOO is the Vanguard S&P 500 Index Fund. You can determine what the ETF fee is by visiting the fund’s overview page. The fee is expressed as a percentage which is charged annually. ETF fees are determined by the fund manager and can change over time. Thank you for your support! How do ETF fees work?Īn ETF fee is the amount of money charged by a fund manager for providing their service. This article may contain affiliate links which pays a commission and supports this blog.

0 kommentar(er)

0 kommentar(er)